How to Create a Budget: A Comprehensive Guide

Managing personal finances can feel overwhelming, but creating a budget is a simple and effective way to take control of your money. A budget serves as a financial blueprint, allowing you to track income, manage expenses, and work towards your financial goals. This detailed guide will walk you through the process of creating a budget that works for your unique needs and lifestyle.

Why Budgeting is Important

Budgeting is more than just a tool for saving money; it’s a key to financial security and independence. Here are some reasons why budgeting is essential:

- Tracks Spending: Helps you understand where your money goes each month.

- Reduces Debt: Identifies areas where you can cut back to pay off debts.

- Achieves Goals: Enables you to save for specific financial objectives like a vacation, home, or retirement.

- Prepares for Emergencies: Builds an emergency fund for unexpected expenses.

- Reduces Stress: Provides a sense of control over your financial situation.

Step 1: Understand Your Income

- The first step in creating a budget is understanding your total income. This includes all sources of money you receive regularly:

- Primary income: Your paycheck from your main job (use net income, not gross income).

- Secondary income: Freelance work, side hustles, rental income, etc.

- Irregular income: Bonuses, tax refunds, or occasional earnings.

- Make a list of these income sources and calculate the total amount you can expect each month. If your income fluctuates, use an average based on the past six months.

Step 2: Track Your Expenses

- Before creating a budget, it’s crucial to understand how you’re currently spending your money. This step involves:

- 1. Reviewing Past Spending: Gather your bank statements, credit card statements, and receipts for the last 1-3 months.

- 2. Categorizing Expenses: Break down expenses into categories such as:

- Fixed Expenses: Rent, utilities, insurance premiums.

- Variable Expenses: Groceries, dining out, entertainment.

- Irregular Expenses: Gifts, repairs, travel.

- 3. Analyzing Spending Habits: Identify areas where you tend to overspend and areas where you could cut back.

Step 3: Set Financial Goals

- Having clear goals gives your budget purpose. Financial goals can be short-term, medium-term, or long-term:

- Short-Term Goals: Saving for a vacation, paying off a credit card, or building an emergency fund.

- Medium-Term Goals: Buying a car, starting a business, or saving for a wedding.

- Long-Term Goals: Retirement savings, buying a house, or funding a child’s education.

- Assign a timeline and specific amount to each goal. For example, “Save $5,000 for a car in 12 months.”

Step 4: Choose a Budgeting Method

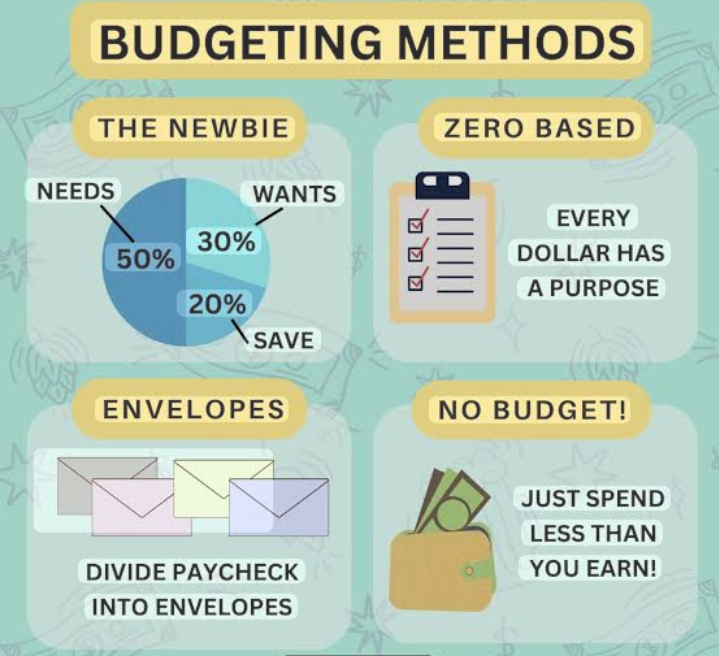

- There are several popular budgeting methods to consider. Choose one that aligns with your financial goals and lifestyle:

- 50/30/20 Rule

- This method divides your income into three categories:

- 50% Needs: Essentials like housing, food, and utilities.

- 30% Wants: Non-essential spending like dining out, entertainment, and shopping.

- 20% Savings/Debt Repayment: Emergency funds, retirement savings, and paying off debt.

Zero-Based Budget

- In a zero-based budget, every dollar of your income is assigned a purpose:

- Start with your income.

- Subtract all expenses, savings, and debt payments.

- The result should be zero.

Envelope System

This cash-based method involves setting aside money for each spending category in envelopes. Once an envelope is empty, you can’t spend more in that category until the next budgeting period.

Custom Method

Create a custom budgeting approach that works for your unique financial situation. This might involve combining elements of different methods.

Step 5: Plan Your Spending

Now that you’ve chosen a budgeting method, it’s time to allocate your income:

- 1. List All Expenses: Include every expense, from rent and groceries to subscriptions and entertainment.

- 2. Set Spending Limits: Assign realistic spending limits to each category.

- 3. Prioritize Needs: Ensure essentials are fully covered before allocating funds to wants and savings.

- 4. Account for Irregular Expenses: Set aside a small amount each month for irregular or unexpected expenses.

Step 6: Automate Savings and Payments

- Automating your finances can help you stick to your

- budget and save time:

- Set Up Direct Deposits: Allocate a portion of your paycheck to savings automatically.

**Autom

Leave a Reply