- Retirement planning may appear difficult given the wide variety of retirement plans available today.

- Knowing your alternatives is essential to creating a financially secure future, regardless of when you’re beginning your work or approaching retirement.

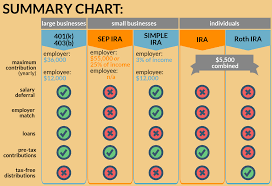

- We’ll explain the most popular retirement account kinds, their functions, and why one could be ideal for you in this post.

- A conventional individual retirement

- account, or IRA

Individuals can make pre-tax contributions to a Traditional IRA, which can lower their taxable income in the year they make the contribution. You won’t have to pay taxes on the investments until you take them out in retirement because they grow tax-deferred.

Important attributes:

- Taxes paid on retirement withdrawals

- Age 73 marks the start of Required Minimum Distributions (RMDs).

Ideal For:

- People who anticipate being in a reduced tax band when they retire.

- The Roth IRA

You won’t receive a tax break right away since a Roth IRA is financed with after-tax money, unlike a Traditional IRA. However, both the growth of your money and any qualified withdrawals are tax-free. Important attributes: No tax deduction right away Growth and withdrawals free from taxes No RMDs for the duration of the account holder’s life Ideal.

- The 401(k)

- Matching contributions, which are essentially free money for your retirement, are provided by many employers. Important attributes: High limits on contributions Employer match, if available Growth postponed by taxes Ideal For: Workers who want to save as much as possible for retirement, particularly with company matching.

- The Roth 401(k)

A Roth 401(k) combines the elements of a traditional 401(k) and a Roth IRA.While eligible withdrawals are tax-free, contributions are made using after-tax money. Important attributes: sponsored by the employer Retirement withdrawals that are tax-free There are no income restrictions on contributions. Ideal For: Individuals who anticipate higher retirement taxes and prefer higher contribution caps than a Roth IRA.

- Simplified Employee Pension, or SEP IRA

Small company owners and independent contractors are the target audience for a SEP IRA. Compared to standard or Roth IRAs, it permits far higher contribution limits. Simple to assemble and oversee Growth postponed by taxes Ideal For: Independent contractors, independent contractors, and small business owners. - SIMPLE IRA (Employee Savings Incentive Match Plan)

Contributions are possible from both businesses and employees. Important attributes: The employer must provide a contribution (set percentage or match). Reduced contribution caps in comparison to a 401(k) Growth postponed by taxes Ideal For: Small companies seeking a simple retirement plan.

- A Retirement Secret Weapon: The Health Savings Account (HSA)

Although an HSA isn’t a traditional retirement account, it can be a helpful tool for managing retirement. Contributions are tax deductible, grow tax-free, and can be taken out tax-free for authorized medical expenditures. You can withdraw for any reason after the age of 65 without incurring penalties, but you will be responsible for paying taxes on non-medical expenses. Ideal For: People who wish to save money for medical expenses in retirement and have high-deductible health plans.

Concluding remarks

- Your income, work status, and retirement objectives will determine which retirement account is ideal for you.

- A lot of people gain by having multiple accounts, like supporting a Roth IRA and a 401(k). To choose the best mix for your particular circumstances, speak with a financial counselor.

- Make your retirement funds work for you by starting early and maintaining consistency. Your future self will be appreciative!

Leave a Reply